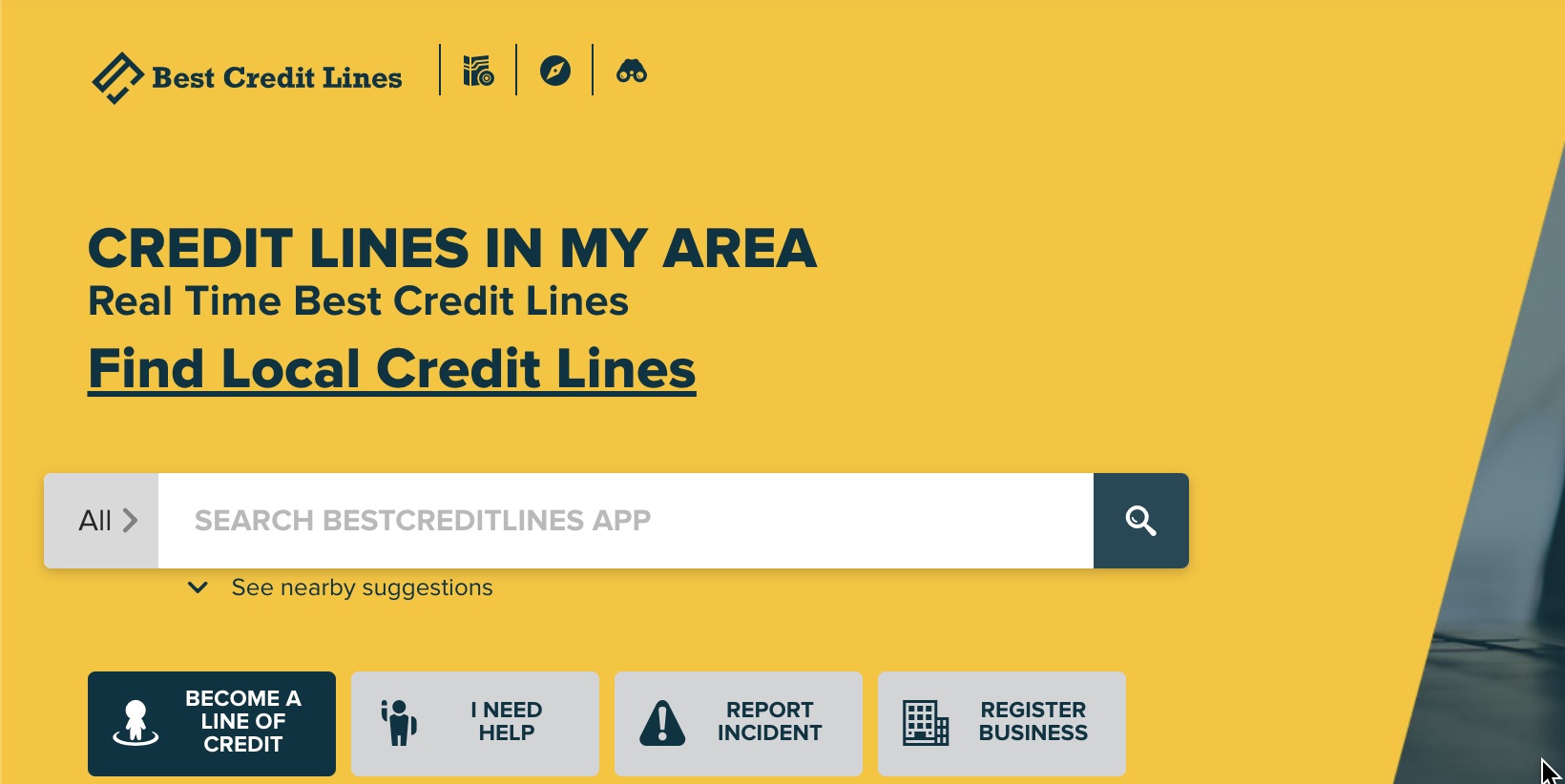

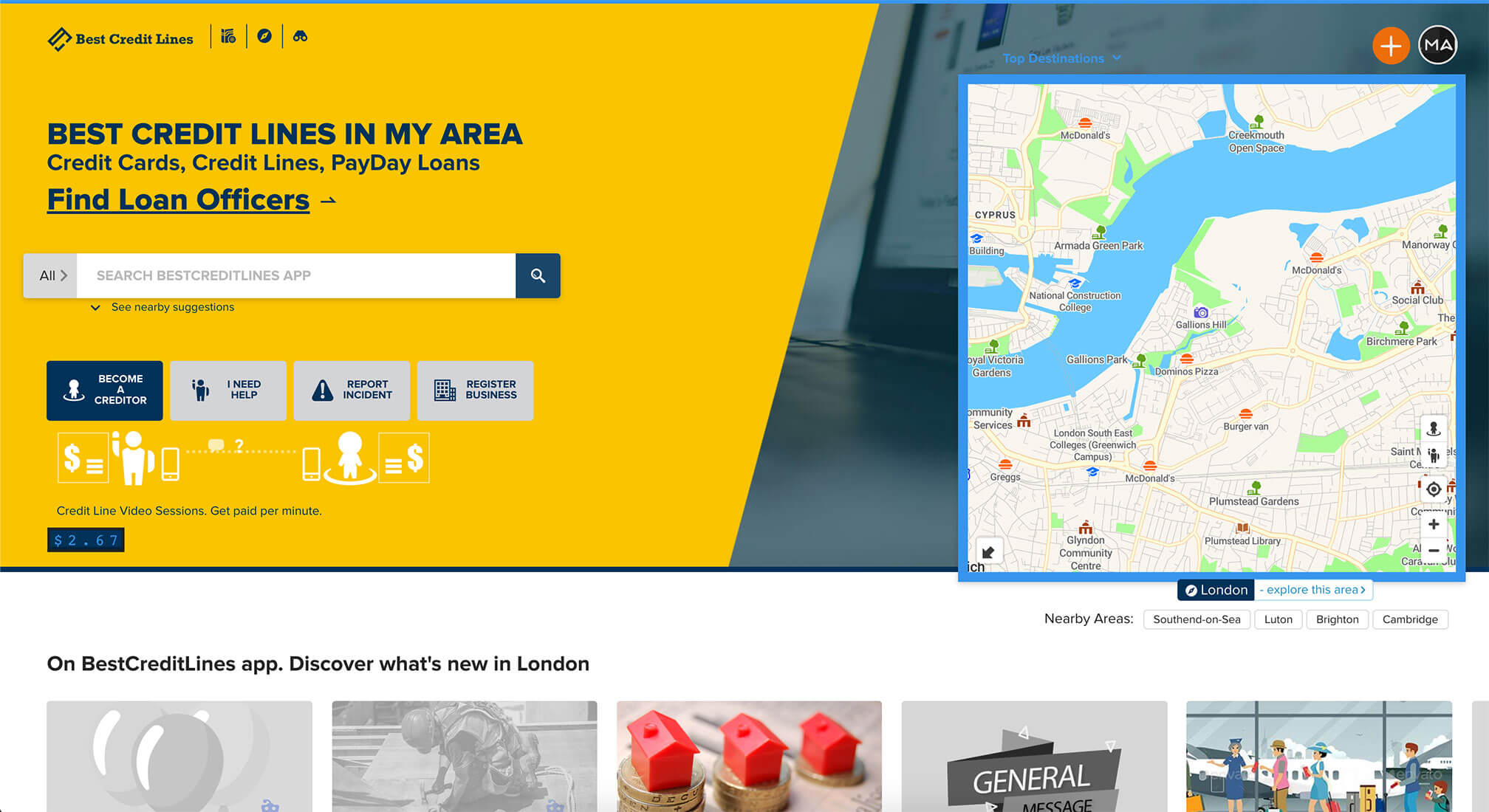

Best Credit Lines in My Area Listing App

Your Loan Officer Listing App will be branded for you, with your logo, your contact information, and your design.

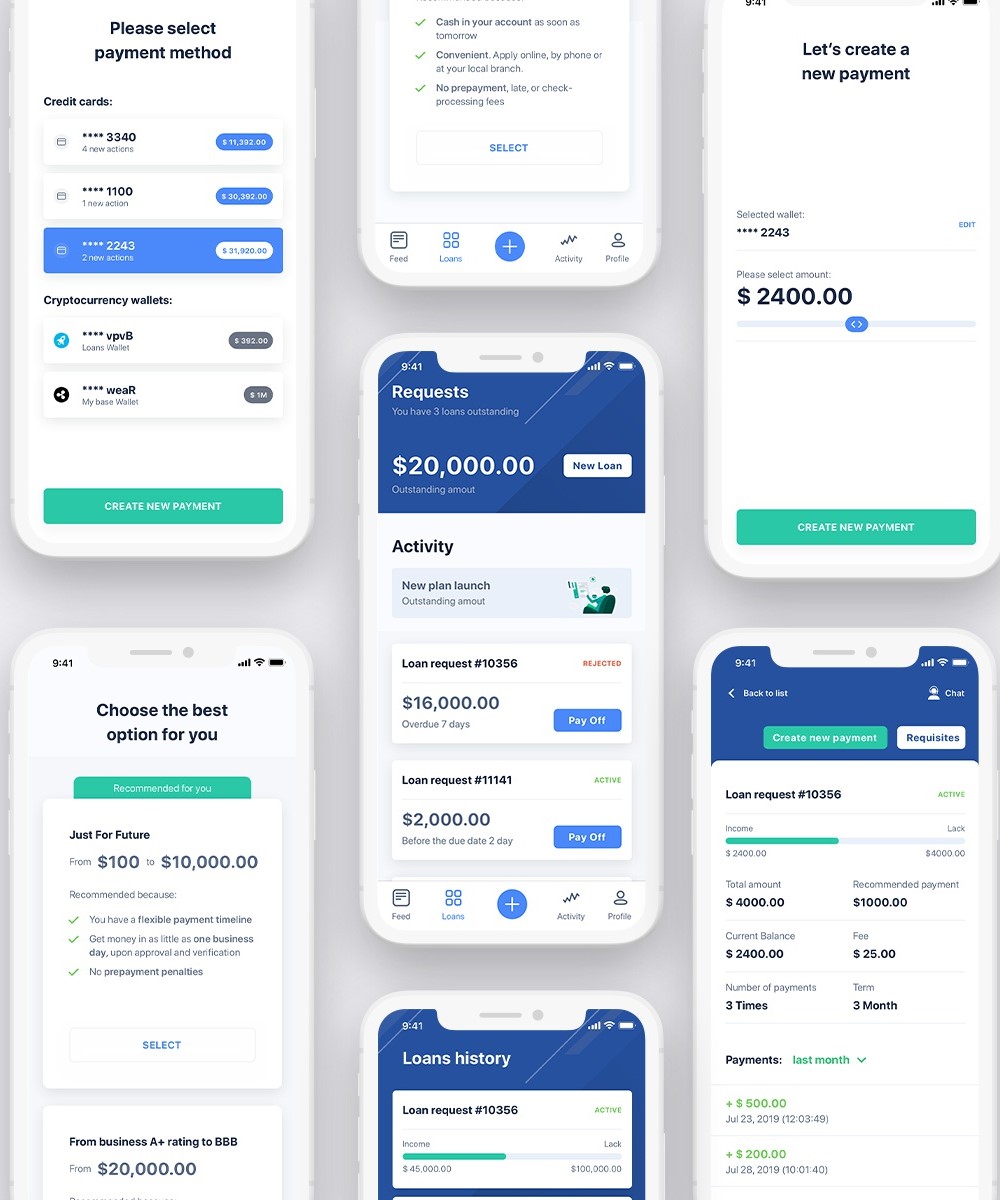

Booking a Lender Appointment is easy - here’s how it works:

- - Open the app and click on Loan Officers.

- - The app asks for the category of the loan you need. Choose a category or tap on ALL.

- - You will immediately see a list of Loan Officers in your area. Want to change the area - just move or zoom the underlying map.

- - View lender's rating and read reviews to learn about other people's experiences with specified loan officer.

- - Tap on a Loan Officer to view his details: pictures, video, loan description, location on the map.

- - Get in touch with the lender. Send an in-app message or simply call. High definition Video calls are embedded within the app.

Search Engine. Find by keywords.

Search Engine. Find by keywords.

Browse Local Area Map

Browse Local Area Map

5 Star Rates & Reviews

5 Star Rates & Reviews

Verified % - Cashback

Verified % - Cashback Add Events, Beaming Signals on Map

Add Events, Beaming Signals on Map Sell Event Tickets

Sell Event Tickets Create Jobs

Create Jobs Video Calls from web and in-app

Video Calls from web and in-app Unlimited Private messages

Unlimited Private messages Media Private Messages

Media Private Messages Public Group Chat

Public Group Chat Pay-Per-Minute Calls

Pay-Per-Minute Calls Claim Cashback in the APp

Claim Cashback in the APp Book a Service

Book a Service